Bitcoin's Impact on the Global Economy is a new movement that has firmly established itself in the mainstream. Few people used to believe that Bitcoin was just a fad or a pipe dream that would fade away in the next few years. Today, however, the situation is entirely different. As you can see, Bitcoin has evolved into a legitimate investment option that is poised to have a significant global influence.

When the price of this popular type of cryptocurrency increased from around 572.3 USD in August 2016 to over 4,764.8 USD in August 2017, it drew a lot of attention. With over 7.1 million acti, it accounts for 64.01 percent of the total value of all cryptocurrencies as of March 9, 2019.

- Bitcoin has the potential to have a significant impact on the global economy because it is designed to revolutionize the present financial system and eliminate financial intermediaries. In some situations, it might serve as a safe-haven asset.

- It's an alternative to the global financial system in some ways. This sort of cryptocurrency has piqued the interest of banking sectors, investors, governments, and businesses in real time.

- Exploring Bitcoin's Role in the Global Economy

- Bitcoin has some characteristics that traditional currencies (gold, silver, etc.) do not. As a result, it has the ability to influence the global economy. For whatever reason, it has been dubbed "digital currencyLinks to an external site." for quite some time. Here are several s

- Storage. Bitcoin is only available in digital form; unlike cash, it has no physical form. As a result, it can only be saved in a digital wallet. If you access this digital wallet from many devices, you can instantly recover it using a seed phrase (new phones, tablets, or any other devices).

- Security. Bitcoin was created as a decentralized digital currency with a real-time transaction method to eliminate the risk of fraud. It also doesn't involve any third-parties or intermediaries, so you have complete control over your assets.

- Portable. Bitcoin, unlike traditional currency and valuables, may be readily "carried" around.

- Anonymity. Bitcoin in a digital wallet does not need to be linked to any specific identifying information. As a result, it's the polar opposite of traditional banks, which know everything there is to know about their customers (from personal data to their financial records).

- Payment Methods are the various ways in which you can make a payment. As previously said, Bitcoin is a digital currency and a new type of money, which means it may be used to make payments. Many businesses in a variety of industries already accept Bitcoin as a viable form of payment.

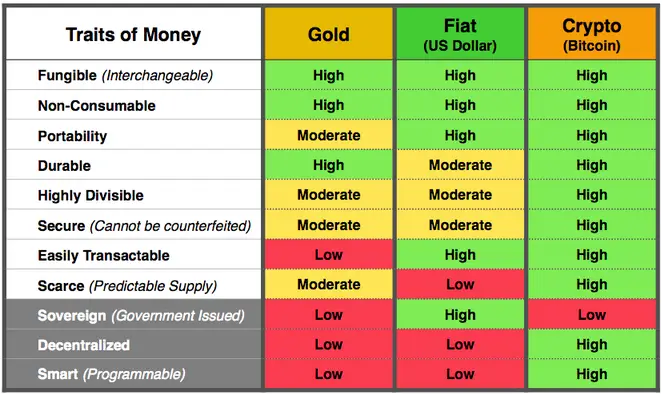

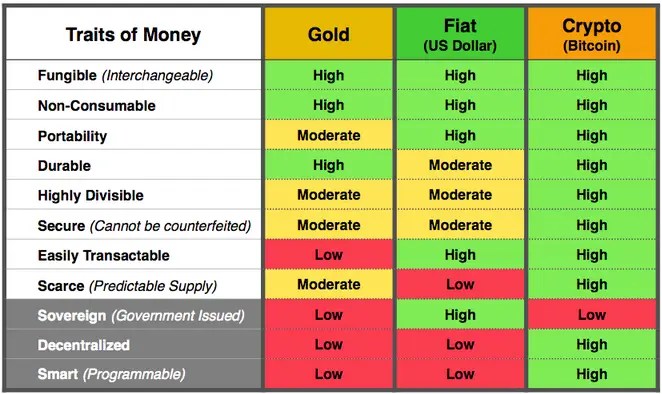

- Here's a comparison of bitcoin to other currencies (gold and fiat money) to help you understand why this digital currency is worth discussing.

Bitcoin's Impact on the Global Economy

Bitcoin's tale is only just beginning, but it is already reshaping the global economy. In this case, it's critical to understand how the global economy and market will be shaped in the following years. Here are some of Bitcoin's visible effects on the global economy.

#1. Global Investment Shifts

Many investors are now diversifying their portfolios using cryptocurrencies, particularly Bitcoin. This is most likely due to the fact that bitcoin allocation increased their prospects of increasing portfolio gains. Take a look at the following graph.

“A tiny allocation to bitcoin greatly increases the cumulative return of a 60 percent stock and 40 percent bonds portfolio allocation mix while only little altering its volatility,” VanEck notes in the figure above.

On the other hand, other experts are concerned about the possibility of a global financial crisis if Bitcoin collapses. At the end of the day, though, investors see cryptocurrencies as a way to protect themselves from inflation.

#2. Distinguishes transactions from the value of the dollar

Cryptocurrencies are not tied to the US dollar in any way. The parties to a financial transaction are provided a new way to engage in the global economy while also avoiding the risks of traditional financial transactions.

Even though it may appear to be a threat to the government since the US dollar serves as the global economy's reserve currency (and hence the primary source of US worldwide authority), it allows for greater international interactions.#3. Does away with the need for middlemen

Bitcoin is built from the ground up to facilitate peer-to-peer electronic transactions between counterparties without the need for a middleman. Unlike traditional cash, it does not require the use of an intermediary or go-between. Decentralized validation is used to validate transactions.

Banking organizations are concerned about this reality since it eliminates the necessity for their services. Furthermore, trading through the internet is a convenient way to do business.

Each day in the last three months of 2020 saw an average of 287,492 confirmed Bitcoin transactions around the world.

The transaction is quick, transparent, secure, and discreet. Furthermore, transaction fees may be significantly lower than in traditional payment systems (credit or debit cards).

#5: It lessens the reliance on fiat money.

Bitcoin, being a decentralized money, is immune to the economic and political difficulties that plague traditional currencies. That is why Bitcoin was created as a digital currency that may be used as a substitute for legal tender or fiat money.

Customers are increasingly depending on digital transfer (because to its convenience in terms of transaction speed) as a convenient method of paying for goods and services. Using Bitcoin as a payment option can help you cut down on your reliance on banks.

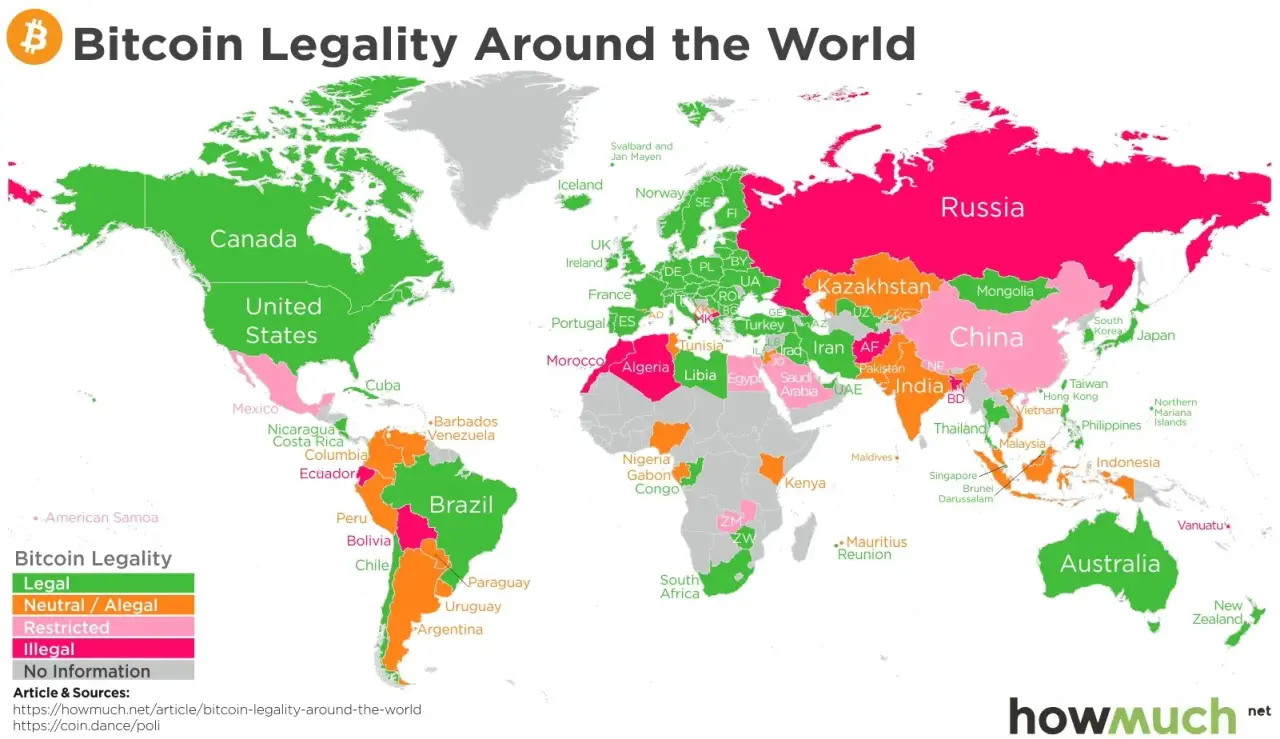

#6. Bitcoin Regulation

Now that Bitcoin is so widely used, national and regional governments are scrambling to update their banking legislation. Central banks are working hard to bring this improvised financial system under control. It could lead to legislation addressing Bitcoin's cryptocurrency and the possibility for a speculative bubble.

Diverse nations have taken different approaches to cryptocurrency, with some (Algeria, Bolivia, Morocco, Nepal, Pakistan, and Vietnam) outright prohibiting any and all Bitcoin-related operations.

Others, on the other hand, use it as a kind of payment. The European Union, for example, accepts cryptocurrencies in the United States, Canada, and Australia.

#7. Removes Entry Barriers and Creates a New Market

Bitcoin created a global decentralized transaction network that does away with the need for centralized organizations to issue and settle currency. In this scenario, it has paved the way for a new type of market and opportunities in which the money market is not controlled by any body or individual.

Rather than convincing venture capitalists, banks, and other financial institutions to fund their business, they can use Initial Coin Offerings to circumvent restrictions and authority (ICO). Startups and small enterprises all around the world can use an ICO to sell part of their coins in order to get their venture off the ground.

#8. Opens Access to a Credit System

Bitcoin enables unbridled access to a reliable credit system since it’s a type of unregulated digital currency that’s based wholly on data. If the price remains stable for an extended period, it’ll be able to bridge people who are isolated from global merchants continuously.

Thus, it will open new markets as well as new opportunities that can contribute to sustainable and inclusive growth in the global economy. What’s more interesting is that Bitcoin does not require any pricey fees for transactions, which makes it much more appealing for its users– and people who are considering using it.

#7. Lowers entry barriers and opens up new markets

Bitcoin built a global decentralized transaction network that does away with the need for centralized organizations to issue and settle currency. In this scenario, it has created a new type of market and opportunities in which the money market is not controlled by any body or individual.

Instead of convincing venture capitalists, banks, and other financial institutions to fund their business, they can use Initial Coin Offerings to circumvent the restrictions and authorities (ICO). Startups and small enterprises all over the world can use an ICO to sell some of their coins in order to fund their operations.

#9: Ushers in a New Age of Crowdfunding

When it comes to Bitcoin and cryptocurrencies, it's impossible to avoid mentioning initial coin offerings (ICOs). It was the buzz of the town in 2017, as it became the most popular crowdfunding technique for blockchain-based enterprises. This new type of crowdfunding allows businesses and groups to raise funds using cryptocurrencies.

According to CB Insights, almost 5x more capital was invested in ICOs in 2017 than in equity financings for blockchain businesses, as shown in the graph above. By the end of 2017, the figure had risen to a staggering 7x.

ICO crowdfunding operates similarly to the stock market in that investors purchase cryptocurrency coins that represent shares in the project. As a result, if the company performs well, the value of the shares may rise. It's known as cryptocurrency equity crowdfunding.

This new era of crowdfunding is critical in assisting innovators, entrepreneurs, and creators in making the world a better place, including establishing a sustainable economy.

#10 International Remittances Industry Changes

In emerging economies, remittances from abroad drive economic growth. Many people all around the world work in this way and send money home to their families and loved ones on a regular basis.

At the moment, this money must be managed through middlemen, such as banks or other money transfer providers, which demand significant transaction fees. Furthermore, the transaction process is extremely slow, taking several days for the receiving party to get the monies. Bitcoin is a game-changer in this situation.

Bitcoin can be securely sent across the globe in real time. It simplifies and lowers the cost of sending money overseas.

Environmentalism (#11).

Every coin has two sides, and Bitcoin is no exception. Apart from the direct and obvious influence Bitcoin has on the global economy, it also has a not-so-subtle impact on the environment.

Bitcoin mining necessitates a complex software and hardware infrastructure system, and it is estimated that it consumes more energy than the entire globe does today.

Operating the computers and networks that power Bitcoin operations consumes at least 77 TWh (terawatt-hour) each year.

With more people participating in the Bitcoin network and attempting to mine it, this incredible quantity of energy has the potential to grow even more.

In such instances, an environmental law and regulatory framework to handle bitcoin mining's energy consumption will be required.

Is Bitcoin a Global Reserve Currency in the Global Economy?

Bitcoin has already allowed many investors (including individuals, businesses, and governments) to grow and prosper as the most well-known and highly-valued sorts of cryptocurrencies. Simultaneously, many people rely on trading as their principal source of income.

The global economy is gradually and slowly transforming in this regard.

With more people participating in the Bitcoin network and attempting to mine it, this incredible quantity of energy has the potential to grow even more.

https://bitpin.ir/coin-list.

In such instances, an environmental law and regulatory framework to handle bitcoin mining's energy consumption will be required.

Is Bitcoin a Global Reserve Currency in the Global Economy?

Bitcoin has already allowed many investors (including individuals, businesses, and governments) to grow and prosper as the most well-known and highly-valued sorts of cryptocurrencies. Simultaneously, many people rely on trading as their principal source of income.

icons at the top right corner of the subsection.

icons at the top right corner of the subsection.